When it comes to insurance, we stand out.

Founded in 2011, IIB (Thailand) Co., Ltd. is a distinguished insurance broker authorized by the Office of Insurance Commission (OIC). We offer a comprehensive range of insurance options for individuals and businesses. Our approach focuses on personalized client service, fostering long-term relationships, and providing expert advice. Our dedicated team supports our clients by simplifying their choices for protection with transparent, affordable, and dependable insurance solutions.

Health Insurance

A wide range of insurers offer policies locally and internationally, with coverage options that include Thailand, regional, or global protection. At IIB Insurance Brokers, we leverage our extensive experience to guide Thais, expatriates, families, foreign residents, retirees, and those needing to meet residence visa insurance requirements. We access a diverse portfolio of policies from both local and international insurers to perfectly match our clients' needs and budgets.

Motor Insurance

In Thailand motor insurance is mandatory for all vehicles, whether trucks, buses, or other forms of transport. Given that there are over 150,000 road accidents annually in Thailand, having robust insurance coverage provides essential peace of mind in the event of an unforeseen accident.

Property Insurance

Whether you are a homeowner or own business premises, your property likely represents a significant investment. Understanding the high costs associated with repairing property damage from fires, storms, or other accidents is crucial.

Business, Professional, and Industrial Insurance

IIB Thailand offers a diverse range of insurance for all types of businesses. From Comprehensive General Liability (CGL) Insurance to Erection All Risk (EAR) Insurance, Legal Liability Insurance (Corporate & Professional), Industrial All Risk (IAR) Insurance, and more. Contact us today to make sure your business has the protection it needs.

Tour Operator Insurance

Tour operator insurance, or tour operator liability insurance, is a specialized form of coverage crafted to address the specific needs of tour operators and guides. This insurance not only safeguards your business against risks associated with your operations but also enhances your professional image, fostering trust among your clients by demonstrating your company's preparedness for any unforeseen incidents.

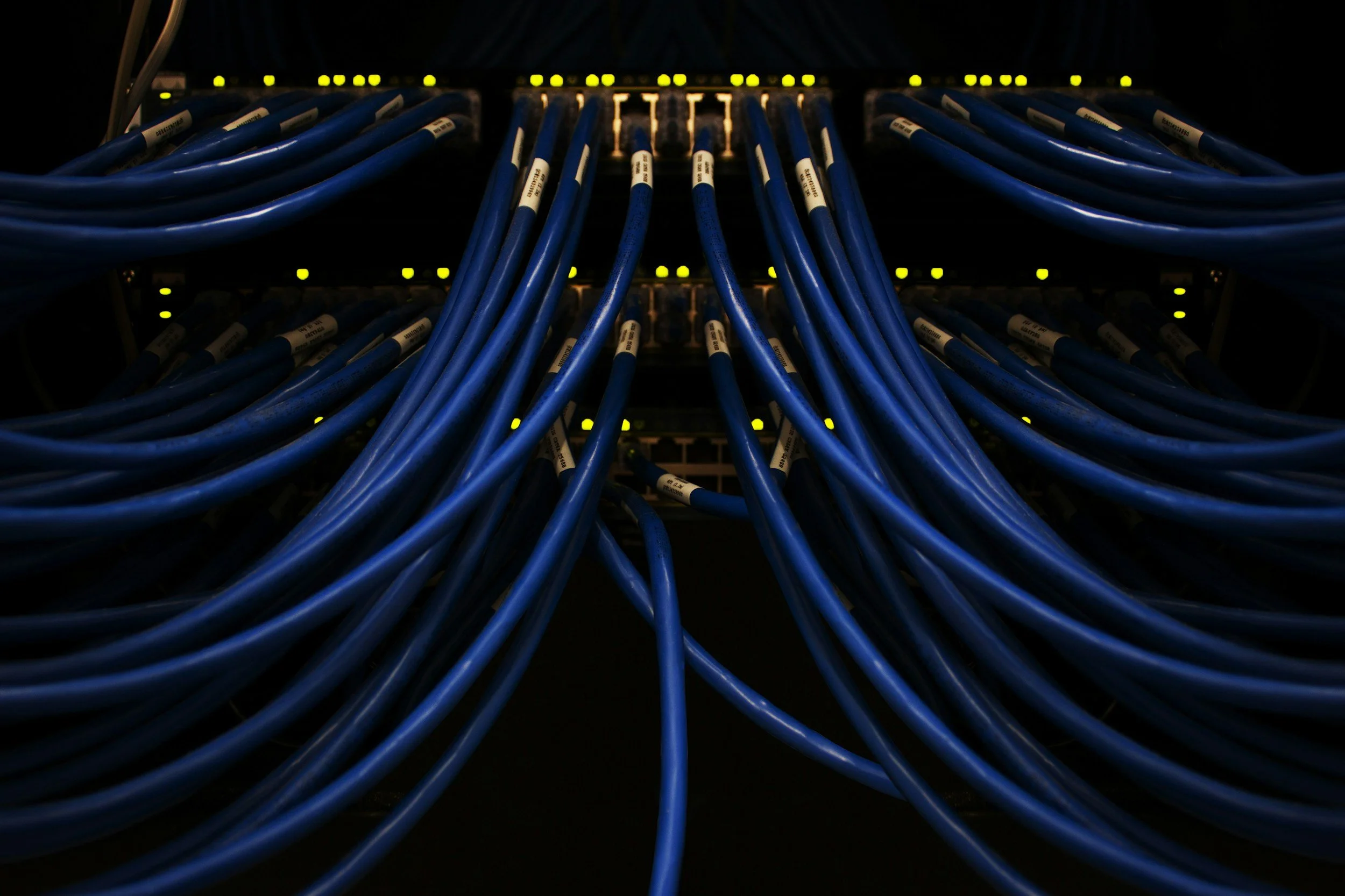

Cyber Liability Insurance

Cyber liability insurance, also known as cyber insurance or cybersecurity insurance, provides coverage for your business's liability arising from data breaches and other cybersecurity risks. As the use of the internet for transactions increases and technologies become more complex, so do the threats we face. Despite robust protections like firewalls and other security software, any company is susceptible to breaches of sensitive customer or employee information.

Other Insurance

In general, if it exists—whether physical or virtual—it can be insured. Please don't hesitate to contact us for any insurance needs you may have that haven't been mentioned above. We are here to assist you in any way possible.